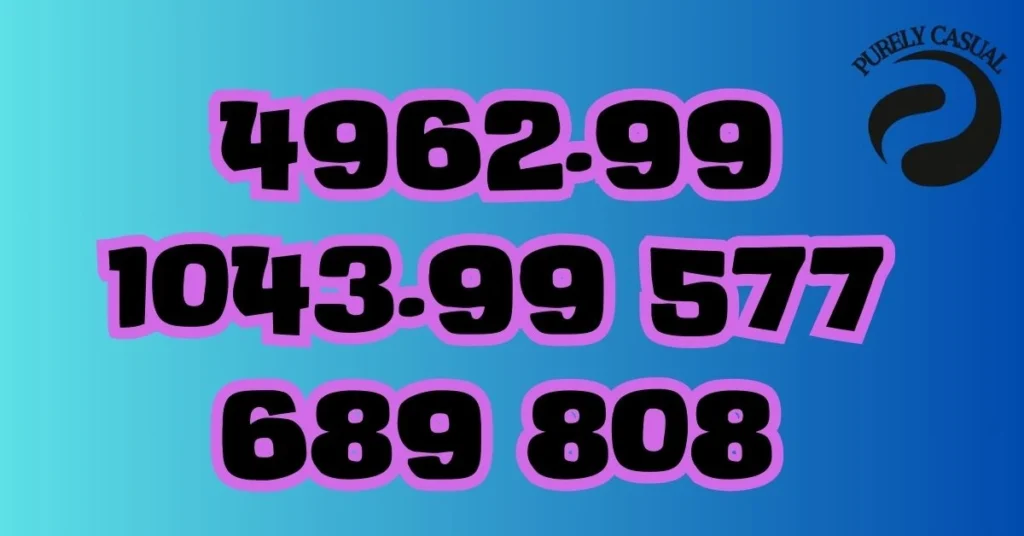

The sequence “4962.99 1043.99 577 689 808” might look random, but it can reveal important financial insights. Numbers like these often represent key business data, such as costs, revenues, or performance indicators. Understanding these figures can help optimize your financial decisions and improve business performance.

In business, every number tells a story. The sequence of numbers could relate to budget allocations, technology investments, or operational metrics. For example, $4962.99 might be the cost of office supplies, while $1043.99 could be a software investment. Numbers like 577 or 689 might reflect production units or staff hours. Together, they offer a snapshot of a company’s financial activities.

Decoding these numbers is essential for better financial management. By understanding what they represent, businesses can make informed decisions on spending and investment. This allows them to maintain a balance between costs and revenues, which is key to profitability. Companies that analyze these figures regularly can spot inefficiencies and optimize their operations.

Financial performance optimization depends on accurate data interpretation. Tools like financial software make it easier to break down these figures into actionable insights. With the right approach, businesses can turn complex sequences into a roadmap for success. In this blog post, we will explore how these numbers can be applied to various financial situations and help improve overall business performance.

Also read:https://purelycasual.com/cs-servicecentervip/

Table Of Contents

Decoding the Figures: What Do the Numbers Represent?

Understanding 4962.99: Budget for Supplies or Equipment

The first number, 4962.99, could represent a business’s budget for essential supplies or equipment. This might include office supplies, machinery, or tools that a company needs to operate smoothly. Regular budgeting for these items helps a business maintain productivity without overspending.

1043.99: Investment in Software or Technology

The second figure, 1043.99, may indicate money allocated for software or technology upgrades. Businesses need to invest in modern technology to stay competitive and efficient. This figure could cover the cost of essential software, updates, or licenses required for day-to-day operations.

577: Key Performance Indicator (KPI) – Units Sold or Produced

The number 577 could represent a KPI, such as the number of units sold or produced. KPIs are crucial for tracking business success. Knowing how many products or services were sold helps businesses understand demand and manage their inventory.

689: Hours Worked or Project Milestones

The figure 689 might refer to the total number of employee hours worked or project milestones achieved. Tracking employee work hours helps businesses allocate resources efficiently. It could also represent the progress of ongoing projects, ensuring they stay on track.

808: Revenue or Financial Balance

The last number, 808, could represent a financial balance point, such as total revenue or profit margins. This number might reflect how well a company is balancing its costs against its income. Regularly reviewing these figures helps ensure the business stays profitable.

Each of these numbers offers insight into different aspects of financial performance. Understanding their significance is key to making informed business decisions.

Financial Performance Optimization Through Numerical Analysis

Using Numerical Analysis to Improve Budget Allocation

Numerical analysis helps businesses make smarter budget decisions. By examining figures like 4962.99, companies can decide whether they are spending too much on supplies. If the budget exceeds what’s necessary, they can reduce costs and reallocate funds to more critical areas.

Identifying Inefficiencies in Cost Management

Numbers like 1043.99 help identify where money is being spent on technology or software. Businesses can analyze these expenses to check if they are getting the best return on investment. If a software tool is underperforming, it may be time to switch to a more cost-effective solution.

Tracking KPIs for Business Success

Key Performance Indicators, such as 577 units sold, show how well a business is performing. Monitoring KPIs ensures that a company meets its sales goals. If numbers are low, it can signal a need for better marketing or sales strategies.

Optimizing Resource Allocation with Hours Worked

Tracking 689 employee hours or project milestones helps in resource management. Businesses can see if they are using their workforce efficiently. If some projects are taking too long, it might be necessary to adjust timelines or reassign staff.

Balancing Revenue and Costs for Profitability

The number 808 may indicate the balance between revenue and costs. Numerical analysis can reveal if a company’s expenses are eating into profits. By adjusting spending and maximizing revenue, businesses can ensure long-term financial health.

Financial performance optimization depends on regularly analyzing these figures. This approach helps businesses stay on track, minimize waste, and boost profitability.

Practical Application: From Numbers to Actionable Insights

Case Study 1: Improving Profitability with 4962.99

A company allocated 4962.99 for office supplies every quarter. After reviewing this figure, they realized they were overspending on unnecessary items. By cutting back on non-essential purchases, they saved money and redirected funds toward marketing, boosting sales.

Case Study 2: Investing in Better Technology with 1043.99

A business noticed that they were spending 1043.99 on outdated software every year. After reviewing their options, they decided to invest in a newer, more efficient program. This change led to better performance, helping them streamline operations and reduce long-term costs.

Case Study 3: Boosting Sales with KPI Analysis

By analyzing the sale of 577 units, a company realized that demand for one of their products was higher than expected. They increased production and ramped up marketing efforts. This resulted in a significant boost in sales and customer satisfaction.

Case Study 4: Managing Employee Hours with 689

A company was tracking 689 employee hours for a key project. After reviewing the time spent, they noticed that the project was falling behind schedule. By reallocating resources and improving workflow, they completed the project on time without exceeding the budget.

Case Study 5: Balancing Revenue with 808

In one business, 808 represented their total revenue from a specific product line. By comparing this figure to their costs, they realized the profit margin was too low. They adjusted pricing and reduced production costs, leading to better profitability.

These real-world examples show how various financial sequences can guide critical business decisions. Turning data into action helps companies optimize their performance and achieve better results.

Conclusion

Understanding the significance of various financial metrics is more than just a financial exercise—it’s a path to smarter business decisions. Each figure represents a different part of the business, from supplies and technology investments to sales and revenue tracking. By analyzing these numbers, businesses can gain insights into their operations and find ways to improve.

Financial performance optimization depends on regularly reviewing and acting on key data points. Whether it’s cutting unnecessary costs or investing in more efficient tools, the numbers guide companies toward profitability. With a focus on balancing revenue and expenses, businesses can maintain long-term financial health.

Incorporating numerical analysis into daily operations can transform how businesses allocate resources, track KPIs, and manage costs. By turning these figures into actionable insights, companies can unlock their full potential and ensure sustainable growth.

FAQs

What does the sequence “4962.99 1043.99 577 689 808” mean in a business context?

The sequence represents various financial metrics and allocations within a business. For example, 4962.99 could be a budget for supplies, 1043.99 may indicate software costs, 577 might reflect units sold, 689 could represent hours worked, and 808 might show total revenue or profit margins.

How does financial data interpretation help with cost management and profitability?

Financial data interpretation allows businesses to analyze expenses, identify inefficiencies, and make informed decisions. By understanding where money is spent and how it relates to revenues, companies can adjust their strategies to improve profitability and minimize unnecessary costs.

What tools can small businesses use for numerical financial analysis?

Small businesses can use various financial software tools such as QuickBooks, Xero, and FreshBooks. These tools help track expenses, revenues, and KPIs, making it easier to analyze financial data and optimize performance.

How can I apply these numbers to my own business?

To apply these numbers, start by tracking your business expenses and revenues closely. Identify key metrics similar to the numbers discussed and analyze them regularly. Use the insights gained to make informed budgeting and investment decisions.

Why is it important to track Key Performance Indicators (KPIs)?

Tracking KPIs is essential for measuring business performance against goals. KPIs provide insights into sales, productivity, and efficiency, helping businesses understand their strengths and weaknesses. This information is crucial for strategic planning and decision-making.